Whether you’re looking for a new career opportunity, in-between jobs, or seeking a side income opportunity, residential mortgage loan origination can be rewarding.

This resource serves as an introductory guide for the steps, entities, and time required for a new candidate to become a licensed Mortgage Loan Originator. Polley Associates is proud to present these courses offered through our partnership with OnCourse Learning which holds the state regulatory approvals for mortgage classes.

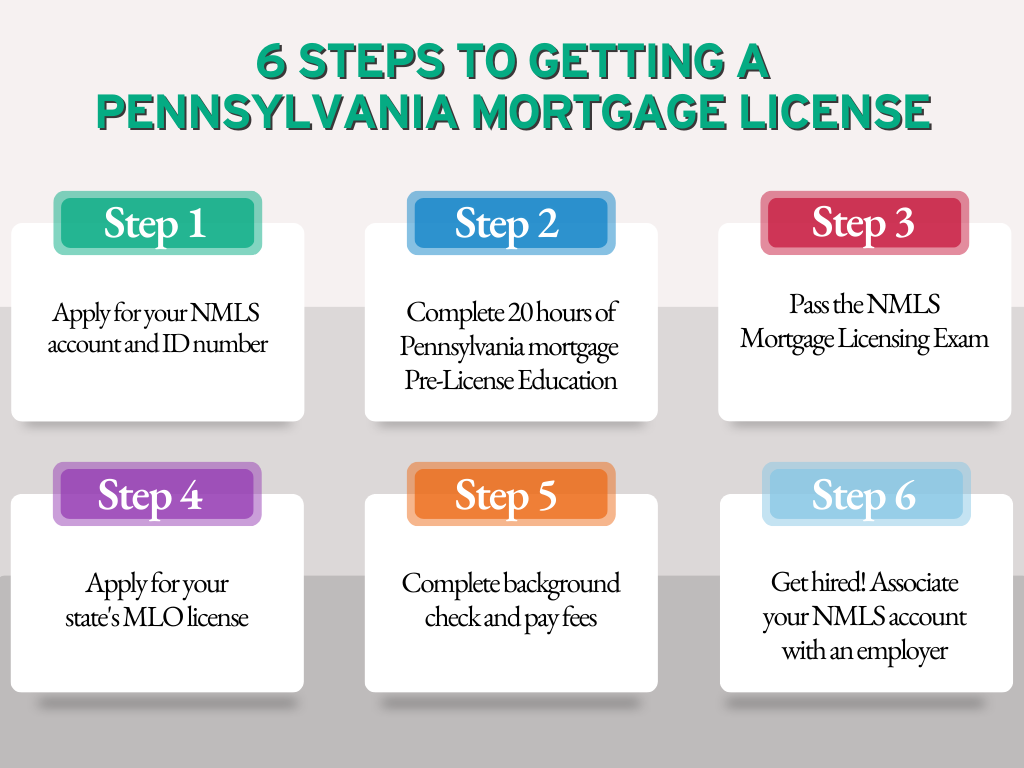

Step 1

Request your personal NMLS account.

- Visit the NMLS online registration portal to request an NMLS account

- Select the Individual option

- If prompted, complete the security captcha and click next.

- Provide the required information and submit it to create your NMLS account

Step 2

Complete Your NMLS Pre-License Education.

All states require 20 hours of mortgage education from an NMLS-approved mortgage school.

- 3 hours of federal law

- 3 hours of ethics

- 2 hours of non-traditional mortgage lending training

- 12 hours of electives

- 3-Hour PA SAFE Review of Pennsylvania Mortgage Law

If you are seeking a new mortgage license, be sure to enroll in the 20 hours SAFE course in addition to PA-specific education requirements.

Step 3

Pass the NMLS Mortgage licensing exam, also known as the SAFE MLO Test:

Once you’ve completed your pre-license education, you’ll need to schedule an appointment to take the National Test Component with Uniform State Content through your NMLS account.

Effective April 5, 2021, test details are as follows:

- 120 questions (115 scored)

- 190 minutes

- Cost $110

The SAFE MLO National exam covers:

- Federal mortgage-related laws and ethics

- MLO activities

- General mortgage knowledge

The Uniform State Content (UST) portion of the exam covers:

- Regulatory authority, responsibilities, and limitations

- Definitions and documents

- License law and regulation

- Compliance

Step 4

Apply for your NMLS license:

Once you’ve completed the required pre-licensing education and achieved passing scores on the National and any applicable state-required tests, you will be able to apply for your mortgage loan originator state license on the NMLS website.

To apply for your MLO license:

- Login to your NMLS account.

- Select the filing tab on the top of the screen.

- Select Individual if you are applying as an individual.

- Click Request New/Update.

- If you’re directly responsible for paying the filing fees, click continue.

- If you’re already employed with a mortgage company, your employer may handle this step for you. These fees are not refundable. Check with your employer before you proceed.

‣ Click Add to apply for your state license.

‣ Select PA and click Next.

‣ Select PA Mortgage Loan Originator License and click Next.

‣ Verify that the information is correct and click Next.

‣ Read the final page carefully before proceeding. If the information is correct click Finish.

You’re now ready to finalize your application!

Step 5

Complete Background Checks, Credit Checks and estimated Fees:

The SAFE Mortgage Licensing Act of 2008 established licensing and registration standards for all Mortgage Loan Originators. In order to receive your MLO license, you’ll need to create a Fieldprint account for fingerprinting and register for an appointment. In addition, you’ll have to complete the following requirements through your NMLS account and pay associated fees:

- NMLS Processing

- FBI Criminal Background Check

- Credit Report

- Application

Step 6

Get Hired!

To become a fully licensed MLO in PA, your NMLS ID will need to be sponsored by a state-licensed employer. This sponsorship tells the governing agencies that your employer will be supervising your individual license. You can submit your sponsorship through your NMLS ID.

Once your employer sponsorship is associated with your NMLS ID, you’ll be ready to do business as an MLO in PA!

Additional Requirements:

In addition to registering with NMLS and becoming state-licensed, MLOs are required to:

- Provide fingerprints to the NMLS for an FBI criminal background check and authorize the NMLS to obtain a copy of your credit report.

- State-licensed, non-depository mortgage loan originators are subject to additional requirements under the Secure & Fair Enforcement for Mortgage Licensing Act of 2008 and at a minimum register with the Nationwide Multistate Licensing (NMLS).

- In some states, MLOs also must satisfy state-specific testing requirements to obtain a license. In April 2013, the NMLS launched the Uniform State Test, a section of the national exam, which replaces the state-specific test content for those states that have adopted it.